There are 2 common types of loans, annuity based and linear based. You will find most relevant aspects of each loan stated below.

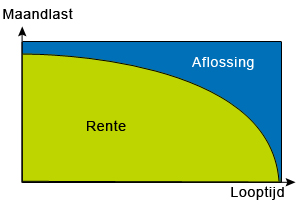

Aspects of annuity based loans:

- interest cost component (in green) will decrease

- repayment cost component (in blue) will increase

- net monthly cost level will increase if income is taxed in the Netherlands

- immediate repayment from the start of the loan period

- total costs of repayment higher than compared to similar linear loan variant

- at the expiry date of the interest fixed period your monthly cost level will change

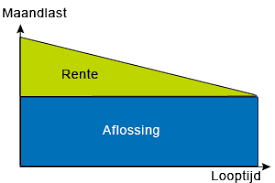

Aspects of linear based loans:

- interest cost component (in green) will decrease

- repayment cost component (in blue) remains equal during loan period

- Initial monthly payments higher than similar annuity based loan but decreasing in time

- gross monthly cost level as well as net monthly cost level will decrease in time

- immediate repayment from the start of the loan period

- total costs of repayment lower than compared to similar annuity based loan variant

- at the expiry date of the interest fixed period your monthly cost level will change

For other types of loans please contact us.