The procedure for taking out a mortgage loan for a newly built home deviates from a mortgage loan application process for an existing home. The selection of potential purchasers for a newly built home is often organised by a lottery procedure.

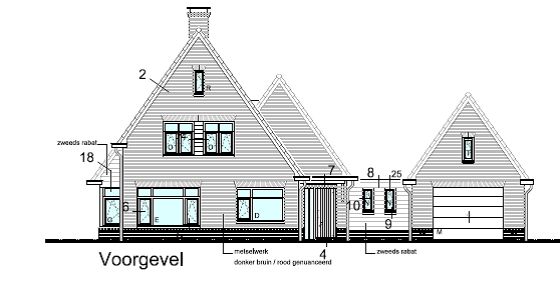

You will buy your future home based on video presentations, various artists impressions and (technical) drawings.

Prior to this stage it is very advisable to have your mortgage advisor assess your financial possibilities – in advance – .

Additional costs for a luxurious kitchen / bathroom, double costs during construction period of your newly built home, and cost aspects have influence on the financial setup.

Price of the newly built houses will (almost always) be V.O.N. (Vrij op Naam), meaning most probably no transfer tax will be charged, no real estate agents costs, no valuation costs and no notary office costs for delivery will be charged. However, Mortgage loan advice & arranging the contract as well as notary office costs for registration of the mortgage loan will be charged.

Advantages Newly Built Homes

Price is most probably fixed and based on V.O.N. (including V.A.T.)

You have a say in decorating / interior layout / Look & Feel

Low energy use (potential discount on regular interest rate based on energy label)

Modern facilities (double glazing, heating pump, good isolation measures, new lines and cables)

Disadvantages Newly Built Homes

Buying from a brochure / drawings / presentations

Meerwerk (extra costs for upgrading standard kitchen, bathroom), etc. (*)

Double costs during the construction period of your newly built home (*)

Renteverlies tijdens de bouw, bouwrente (*)

(*) Luxurious kitchen a/o bathroom (Meerwerk)

To keep the prices of a newly built house attractive for aspirant purchasers the project developers often work with low budget amounts for kitchens, bathrooms, ect. If you want a “more than standard” kitchen a/o bathroom you will have to pay extra. Meerwerk can often be integrated in the mortgage loan finance setup.

(*) Double costs of living during construction period (Dubbele woonlasten tijdens de bouwperiode)

After your mortgage loan is registered at the notary office you will start to pay installments for your newly built home. But your newly built home is not ready yet to move in, so next to the new mortgage loan installments you will also have to pay your current rental installments or your current mortgage loan installments untill you move in your new home (and the old one is sold). These double (mortgage loan) costs can sometimes be integrated in your new mortgage loan contract.